Revenue Department and depa Push for 200% Tax Deduction Measure through Cabinet to Ease Expenses and Enhance Thai SMEs' Competitiveness

Revenue Department and depa Push for 200% Tax Deduction Measure through Cabinet to Ease Expenses and Enhance Thai SMEs' Competitiveness

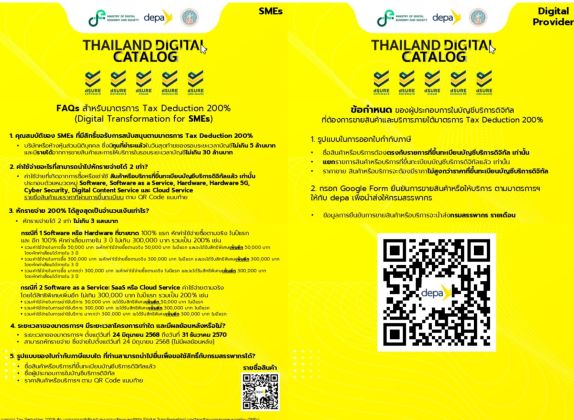

The Digital Economy Promotion Agency (depa), in collaboration with the Revenue Department, is driving a tax incentive to support the digital transformation of small and medium-sized enterprises (SMEs). The measure, approved by the Cabinet, allows SMEs to deduct expenses at twice the amount for purchases, commissions, or service fees related to computer software, hardware, smart devices, or digital services registered on the depa's Digital Service List. The aim is to encourage the adoption of digital technologies in business operations, enhance competitiveness, and ease the financial burden on Thai SMEs.

Associate Professor Dr. Nuttapon Nimmanphatcharin, President and CEO of depa, revealed that the Cabinet has approved in principle the draft Royal Decree issued under the Revenue Code regarding tax exemption (Draft No. ...) B.E. .... This decree is part of a tax measure proposed by the Revenue Department, Ministry of Finance, to support SMEs’ digital transformation.